Travel Insurance: Why It’s a Must and How to Choose

Planning a trip can be exciting, but unforeseen circumstances can arise, making travel insurance a vital consideration. Whether you’re heading out on a domestic adventure or an international journey, having the right coverage can provide peace of mind and financial protection.

Travel Insurance: Why It’s a Must and How to Choose

Understanding the travel insurance benefits is crucial in making an informed decision. When choosing travel insurance, it’s essential to consider factors such as the type of coverage, policy limits, and deductibles. By doing so, you can ensure that you’re adequately protected against unexpected events.

Key Takeaways

- Understand the importance of travel insurance for your trip

- Learn how to choose the right travel insurance policy

- Discover the key benefits of having travel insurance

- Know what factors to consider when selecting a policy

- Be aware of the financial protection it offers

The Fundamentals of Travel Insurance

Before diving into the world of travel insurance, it’s essential to grasp what it entails and how it works. Travel insurance is designed to protect you against various risks associated with traveling, both domestically and internationally.

What Travel Insurance Actually Covers

Travel insurance policies vary widely, but most cover medical emergencies, trip cancellations or interruptions, and loss or theft of baggage. Some policies also offer coverage for travel delays and missed connections. Understanding the types of travel insurance available can help you choose the one that best suits your needs.

How Policies Typically Work

Generally, travel insurance policies require you to purchase coverage before your trip begins. The specifics of what is covered and to what extent can vary significantly between policies. It’s crucial to review the travel insurance coverage details, including any deductibles, limits, and exclusions. By doing so, you can ensure that you’re adequately protected against unforeseen events that might impact your travel plans.

By understanding the fundamentals, you can make an informed decision when selecting a travel insurance policy.

The Real Risks of Traveling Uninsured

Traveling without insurance can expose you to significant financial risks. When you travel, especially internationally, you’re not just at risk for the usual travel inconveniences like flight delays or lost luggage. You’re also at risk for serious medical emergencies, trip cancellations, and other unforeseen events that can be costly.

Financial Consequences of Emergencies Abroad

Medical emergencies abroad can be particularly costly. For instance, a simple appendectomy can cost upwards of $20,000 in the United States, and similar prices can be expected in many other countries. Without insurance for travelers, you’re left to cover these expenses out of pocket.

Here is a breakdown of potential costs associated with travel emergencies:

| Emergency Type | Average Cost Without Insurance |

| Medical Evacuation | $50,000 – $100,000 |

| Hospital Stay (per day) | $1,000 – $3,000 |

| Trip Cancellation | $1,000 – $5,000 |

Real-Life Horror Stories from Uninsured Travelers

There are many real-life cases where travelers faced financial hardship due to a lack of travel insurance. For instance, falling ill abroad and needing costly medical evacuation can result in overwhelming expenses without proper coverage.

Travel Insurance: Why It’s a Must and How to Choose

As the world becomes more accessible, the importance of travel insurance for modern travelers cannot be overstated. With the rise in global travel, travelers are exposed to a myriad of risks, from trip cancellations to medical emergencies abroad.

Essential Protection for Modern Travelers

Travel insurance is crucial protection against unexpected events that could lead to serious financial loss. Today’s travelers—whether for business or leisure—invest heavily in their trips, making insurance an essential part of smart travel planning.

The right travel insurance plan can cover a range of scenarios, including medical emergencies, trip cancellations, and loss or theft of personal belongings. This comprehensive coverage ensures that travelers are protected against the unexpected, allowing them to enjoy their travels with confidence.

| Type of Coverage | Description | Benefits |

| Medical Emergency | Covers medical expenses abroad, including hospital stays and emergency evacuations. | Ensures access to quality medical care without the burden of high costs. |

| Trip Cancellation | Reimburses prepaid travel expenses if a trip is canceled due to covered reasons. | Protects financial investment in case of unforeseen trip cancellations. |

| Baggage Loss/Theft | Compensates for loss, theft, or damage to personal belongings during travel. | Reduces the impact of losing essential items during travel. |

The Peace of Mind Factor

One of the most significant benefits of travel insurance is the peace of mind it offers. Knowing that you are covered in case of emergencies can greatly reduce travel-related stress, allowing you to focus on enjoying your trip.

With the right travel insurance plan, travelers can rest assured that they are prepared for the unexpected. This peace of mind is invaluable, making travel insurance an indispensable part of modern travel.

Types of Travel Insurance Coverage

Travel insurance comes in multiple forms, each designed to protect against different risks associated with traveling. Understanding these various types can help travelers choose the coverage that best suits their needs.

Medical Emergency Coverage

One of the most critical types of travel insurance is medical emergency coverage. This coverage helps pay for medical expenses if you become ill or injured while traveling. It can include costs for hospital stays, doctor visits, and sometimes even medical evacuations. Medical emergency coverage is particularly important when traveling abroad, as your domestic health insurance may not cover you internationally.

Trip Cancellation and Interruption

Trip cancellation and interruption insurance reimburses you for pre-paid travel expenses if your trip is canceled or cut short due to unforeseen circumstances such as illness, natural disasters, or travel advisories. This type of insurance can provide peace of mind, especially if you’ve invested a significant amount in your trip.

Baggage and Personal Belongings Protection

Baggage insurance covers loss, theft, or damage to your luggage and personal belongings during your trip. This can include reimbursement for essential items if your baggage is delayed. It’s a useful coverage for travelers who check multiple bags or carry valuable items.

Travel Delay and Missed Connection Coverage

Travel delay insurance compensates you for additional expenses incurred due to travel delays, such as accommodation and meal costs. Missed connection coverage helps if you miss a connecting flight due to delays. These coverages can be invaluable if you have tight connections or travel during peak seasons.

By understanding the different types of travel insurance coverage, travelers can make informed decisions about their insurance needs, ensuring they are adequately protected against various risks.

When Travel Insurance Becomes Non-Negotiable

There are times when travel insurance transitions from being a good idea to a must-have. Certain travel plans or activities significantly increase the risk, making insurance coverage not just beneficial but essential.

International Travel Considerations

Traveling abroad, especially to countries with different healthcare systems or higher medical costs, makes having insurance for international travel crucial. Medical emergencies can be extremely costly, and without proper coverage, travelers might face financial hardship.

Adventure and High-Risk Activities

Engaging in adventure or high-risk activities like skydiving, bungee jumping, or deep-sea diving increases the likelihood of accidents. Insurance that covers these activities can be a lifesaver, both medically and financially.

Expensive or Prepaid Trips

For trips that involve significant financial investment, such as prepaid cruises or luxury vacations, travel insurance can protect against trip cancellations or interruptions due to unforeseen circumstances.

Considering when to consider travel insurance is vital. It’s not just about having insurance; it’s about having the right coverage at the right time. Here are key scenarios to consider:

- Traveling to countries with high medical costs

- Engaging in high-risk activities

- Investing in expensive or prepaid trips

Navigating Policy Exclusions and Limitations

Travel insurance policies, while designed to protect travelers, often come with exclusions and limitations that can significantly impact coverage. Understanding these aspects is crucial for making informed decisions when purchasing a policy.

Pre-Existing Medical Conditions

One of the most common exclusions in travel insurance policies is related to pre-existing medical conditions. Many policies either exclude coverage for conditions that existed before the policy was purchased or require additional premiums for such coverage.

High-Risk Activities and Sports

Travelers engaging in high-risk activities or sports, such as skydiving or deep-sea diving, may find that their insurance policy does not cover injuries sustained during these activities. It’s essential to check the policy’s stance on such activities.

Natural Disasters and Political Situations

Policies often have clauses related to natural disasters and political unrest. Understanding these clauses can help travelers assess their risk and make informed decisions about their travel plans.

| Exclusion Type | Description | Potential Impact |

| Pre-Existing Conditions | Medical conditions existing before policy purchase | Claims related to these conditions may be denied |

| High-Risk Activities | Activities like skydiving or deep-sea diving | Injuries during these activities may not be covered |

| Natural Disasters | Events like hurricanes, earthquakes, etc. | Trip cancellations or interruptions due to disasters may not be covered if they occur before or during travel |

By carefully reviewing policy exclusions and limitations, travelers can better understand what is covered and what is not, allowing them to make more informed decisions about their travel insurance needs.

Assessing Your Personal Insurance Needs

Your travel insurance needs are as unique as your travel plans; assessing these needs is key to a well-protected trip. Understanding what to look for in a travel insurance policy can make all the difference in ensuring that you’re covered for the unexpected.

Evaluating Your Health Status and Risks

One of the first steps in assessing your travel insurance needs is to evaluate your health status and any potential risks associated with your trip. If you have pre-existing medical conditions, it’s crucial to choose a policy that covers these conditions.

Consider the following health-related factors:

- Pre-existing medical conditions

- Age-related health concerns

- Planned medical procedures during travel

Destination-Specific Considerations

Different destinations come with different risks. For instance, traveling to areas with a high risk of natural disasters or political unrest may require additional coverage.

| Destination Type | Potential Risks | Recommended Coverage |

| High-Risk Areas | Natural disasters, political unrest | Comprehensive coverage including trip cancellation and interruption |

| Adventure Travel | Accidents during activities like skiing or hiking | Adventure sports coverage |

Analyzing Your Financial Investment in the Trip

Assessing the financial investment in your trip is also crucial. If you have a significant financial investment, you may want to consider a policy that offers trip cancellation and interruption coverage.

By carefully evaluating your health status, destination-specific risks, and financial investment, you can make an informed decision about your travel insurance needs.

When to Purchase Travel Insurance

Understanding when to buy travel insurance is crucial for maximizing your coverage and ensuring a stress-free trip. Travel insurance provides financial protection against unforeseen events such as trip cancellations, medical emergencies, and lost luggage.

Optimal Timing for Maximum Coverage

Purchasing travel insurance at the right time is essential. Buying travel insurance immediately after booking your trip can provide coverage for pre-trip cancellations and interruptions. This timing ensures you’re protected in case unforeseen circumstances force you to cancel or cut short your trip.

Last-Minute Options and Limitations

While it’s possible to buy travel insurance at the last minute, this approach comes with limitations. Some benefits, like pre-existing medical condition coverage, may require purchase within a specific time frame after booking your trip. Delaying your purchase might also mean missing out on certain coverage options.

Therefore, it’s advisable to research and purchase travel insurance as early as possible to maximize your protection and peace of mind.

Comparing Insurance Providers and Policies

Comparing travel insurance policies is not just about finding the cheapest option; it’s about securing the best protection for your trip. With the numerous options available, travelers can easily feel overwhelmed. However, by understanding the key factors to look for, you can make an informed decision that suits your travel needs.

Top-Rated Travel Insurance Companies

Several insurance companies stand out for their comprehensive coverage and excellent customer service. Companies like Allianz Travel Insurance, Travelex Insurance, and AXA Travel Insurance are often rated highly by travelers. These companies offer a range of policies that cater to different types of travelers, from those on adventure holidays to business travelers.

Using Comparison Tools Effectively

Utilizing online comparison tools can simplify the process of evaluating different insurance policies. These tools allow you to input your trip details and receive quotes from multiple insurers, making it easier to compare coverage and prices side by side. When using these tools, ensure you’re comparing policies with similar coverage limits and deductibles.

| Insurance Provider | Coverage Limit | Deductible | Price |

| Allianz | $1,000,000 | $0 | $50 |

| Travelex | $500,000 | $250 | $40 |

| AXA | $1,000,000 | $0 | $55 |

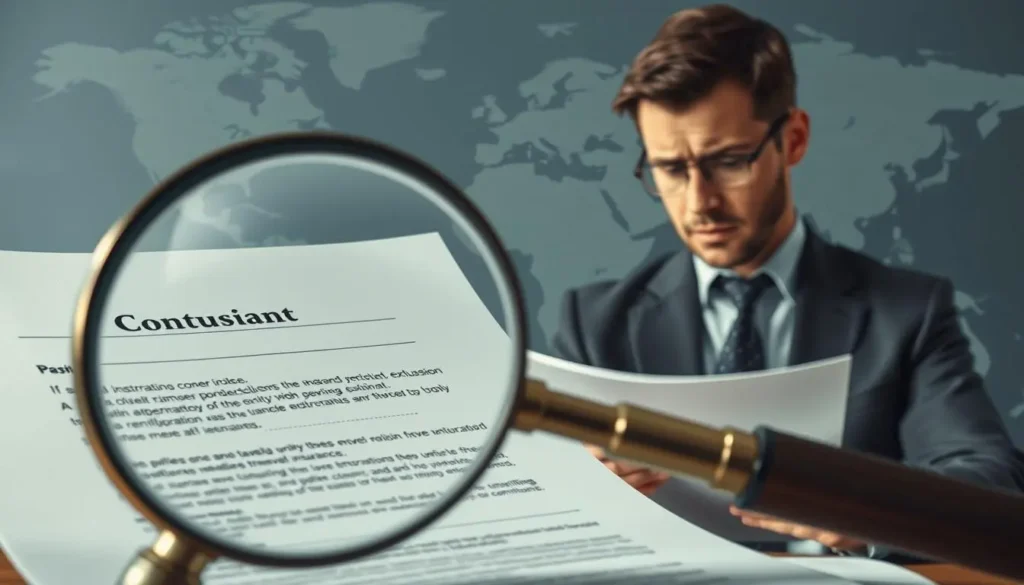

Reading the Fine Print

It’s crucial to read the policy details carefully before making a purchase. Look for exclusions, such as pre-existing medical conditions or specific activities that are not covered. Understanding the claims process and what’s required to file a claim is also vital.

By taking the time to compare insurance providers and policies thoroughly, you can ensure that you’re adequately protected against unforeseen events during your trip.

Cost Factors and Budget-Friendly Strategies

The cost of travel insurance can vary significantly based on several key factors. Understanding these elements can help travelers make informed decisions and choose the most suitable coverage for their needs.

What Determines Premium Prices

Several factors influence the premium prices of travel insurance policies. These include:

- Age and Health Status: Older travelers or those with pre-existing medical conditions may face higher premiums.

- Destination and Duration: Traveling to high-risk areas or for extended periods can increase costs.

- Type of Coverage: Comprehensive policies that include multiple benefits (e.g., medical, trip cancellation, and baggage protection) are generally more expensive.

Smart Ways to Save Without Compromising Coverage

To save on travel insurance without sacrificing essential coverage, consider the following strategies:

- Compare Policies: Research and compare different insurance providers to find the best value.

- Annual Policies: If you travel frequently, an annual policy might be more cost-effective than buying single-trip insurance each time.

Annual Policies vs. Single-Trip Coverage

Choosing between annual and single-trip policies depends on your travel frequency. For frequent travelers, annual policies can offer significant savings and convenience.

Travel Insurance in the Age of Global Uncertainty

As global uncertainties continue to shape our world, the importance of travel insurance has never been more pronounced. Travelers today face a myriad of risks, from pandemics and climate change to political instability and terrorism.

Pandemic-Related Coverage Considerations

The COVID-19 pandemic has highlighted the need for comprehensive travel insurance that includes coverage for pandemic-related disruptions. Many insurance providers now offer policies that cover COVID-19-related trip cancellations, interruptions, and medical emergencies.

When selecting a policy, it’s crucial to review the pandemic-related coverage details, including any exclusions or limitations. Some policies may offer additional benefits, such as coverage for quarantine-related expenses or emergency medical evacuations.

Climate Change and Extreme Weather Protection

Climate change has led to an increase in extreme weather events, which can significantly impact travel plans. Travel insurance can provide protection against trip cancellations or interruptions due to severe weather conditions.

Some insurance policies now include coverage for weather-related events, such as hurricanes, wildfires, or floods. It’s essential to understand the specific terms and conditions of such coverage.

Political Instability and Terrorism Coverage

Political instability and terrorism are growing concerns for travelers. Many travel insurance policies now include coverage for trip cancellations or interruptions due to these factors.

| Coverage Type | Description | Typical Benefits |

| Pandemic Coverage | Covers trip disruptions due to pandemics | Trip cancellation, medical emergencies |

| Weather-related Coverage | Protects against extreme weather events | Trip cancellation, interruption |

| Political Instability Coverage | Covers trip disruptions due to political unrest | Trip cancellation, emergency evacuations |

In conclusion, travel insurance has become a vital component of travel planning in today’s uncertain world. By understanding the various coverage options available, travelers can better protect themselves against a range of global risks.

Conclusion: Investing in Your Travel Security

As we’ve explored throughout this article, travel insurance is more than just a precautionary measure; it’s a vital component of travel planning that ensures your security and financial protection while exploring new destinations.

Understanding the importance of travel insurance can be the difference between a trip ruined by unforeseen circumstances and one that remains memorable for all the right reasons. By investing in travel insurance, you’re not just safeguarding your financial investment; you’re also securing your travel security.

Whether you’re embarking on an international adventure, engaging in high-risk activities, or simply looking to protect your prepaid trip expenses, there’s a travel insurance policy tailored to your needs. As the world continues to evolve, with factors like global uncertainty and climate change affecting travel plans, having the right insurance coverage can provide invaluable peace of mind.

Ultimately, travel insurance is an investment in your travel security, allowing you to explore the world with confidence and enjoy your travels without undue worry about what might go wrong.

FAQ

What is travel insurance, and why do I need it?

Travel insurance is a type of insurance that covers unexpected medical or travel-related expenses while traveling. You need it to protect yourself against financial losses due to trip cancellations, medical emergencies, or lost luggage.

What does travel insurance typically cover?

Travel insurance typically covers trip cancellations, interruptions, or delays, as well as medical emergencies, evacuations, and lost or stolen luggage. Some policies also offer additional coverage for adventure activities or travel delays.

How do I choose the right travel insurance policy?

To choose the right travel insurance policy, consider your destination, the type of activities you plan to do, and your health status. Compare different policies, and read the fine print to ensure you understand what’s covered and what’s not.

Can I purchase travel insurance after booking my trip?

Yes, you can purchase travel insurance after booking your trip, but it’s recommended to buy it as soon as possible to maximize coverage. Some benefits, like trip cancellation, may only be available if you purchase the insurance within a certain timeframe after booking.

Are pre-existing medical conditions covered under travel insurance?

It depends on the policy. Some travel insurance policies cover pre-existing medical conditions, while others may exclude them or require you to purchase additional coverage. Be sure to check the policy details before buying.

How much does travel insurance cost?

The cost of travel insurance varies depending on factors like your age, destination, trip duration, and the type of coverage you choose. On average, you can expect to pay around 5-10% of your total trip cost for travel insurance.

Can I get travel insurance for a single trip or an annual policy?

You can purchase either a single-trip policy or an annual policy, depending on your travel frequency. Annual policies can be more cost-effective if you take multiple trips within a year.

What is the difference between trip cancellation and trip interruption coverage?

Trip cancellation coverage reimburses you for prepaid trip expenses if you need to cancel your trip before departure, while trip interruption coverage reimburses you for expenses if your trip is interrupted or cut short due to unforeseen circumstances.

Are adventure activities or high-risk sports covered under standard travel insurance policies?

Some standard travel insurance policies may not cover adventure activities or high-risk sports. You may need to purchase additional coverage or a specialized policy to be protected.

How do I file a claim with my travel insurance provider?

To file a claim, contact your travel insurance provider and follow their claims process, which typically involves submitting documentation, like receipts and medical records, to support your claim.